Things to Consider for Finding the Best PMS

The pms portfolio management services are

customized for providing investment services by some highly skilled and

professional portfolio managers to get high value from the market. PMS can

become a great investment option for those people who want to diversify their

portfolios, get higher returns, and have the convenience of delegating

investment decisions to experts. It can be a challenging job to find the best

PMS provider as we know several scams and fraudulent activities are going on in

the investment industry.

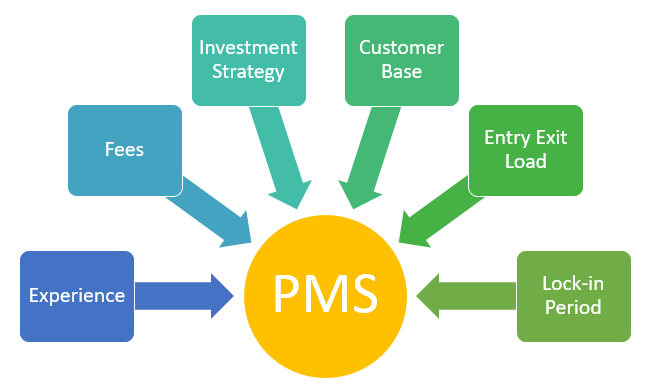

Tips to Find the Best PMS

Following

are some which we need to consider while searching for a portfolio management firm in India with high returns:

- Experience and

Research

If

you are new in the investment industry then first of all you need to do some

basic research about PMS providers. You can search for those PMS providers who

have a good reputation and have better reviews. People need to check the track

record of PMS and know whether they can deliver consistent returns to their

clients or not. People can also conduct a background check on the PMS company

like you can check the qualifications of their portfolio managers and the types

of investment strategies they follow. You need to make sure that the PMS

provider is registered with the Securities and Exchange Board of India (SEBI) and

they should have a valid license for offering PMS service to the clients.

- Fee Structure

Every

PMS provider will charge some fees for their services that will including

management fees and performance fees. So before selecting or signing any PMS

firm you need to understand their fee structure so that you won't face any

conflicts in the future. We advise you to trust only those PMS providers which

offer transparent and reasonable fees and make sure that they are not taking

any hidden fees in your agreement.

- Investment

Strategies

Every

PMS provider follows different investment strategies and philosophies according

to their rules and regulations. You will find that some of the PMS providers

just focus on value investing, while some others may focus on growth investing

or quantitative investing. Hence, it is advised to choose the PMS provider

which is best for your investment and works similarly to your planning with

your goals and risk appetite. You need to make sure while selecting any PMS

firm that they are following some well-defined investment philosophy.

- Portfolio

Diversification

For

finding a good PMS provider you need to look for portfolio diversification as

it is one of the important factors for managing risk and achieving some

long-term investment goals. A good PMS provider will not only have a

diversified portfolio but they should also have exposure to multiple asset

classes and sectors. We would like you to advise that you don't choose a PMS

provider which has a concentrated portfolio or invest in only a single sector

or asset class.

Conclusion

Above

are some tips which you can consider while searching for a good PMS provider

you need to be aware of several red flags of investment scams and avoid all

those PMS providers that exhibit these signs. Many PMS firms will promise you

to provide high returns with no risk, but for some unregistered providers, and

unsolicited investment offers then you should neglect these offers as they can

be scammers.

Comments

Post a Comment